January 28th, 2013

Pot, meet kettle: Tim Eyman attacks Governor Jay Inslee for “employing political spin” on revenue

Rethinking and ReframingStatements & Advisories

Another Monday has arrived, and so has another mid-morning Eyman missive that sounds like it was put together on an assembly line in Tim’s home office. Today’s target is Governor Jay Inslee, who took office less than two weeks ago and is now trying to put together a budget proposal – presumably a proposal that will square with what he said during last autumn’s campaign.

Inslee and his team are weeks away from presenting their budget, but that hasn’t stopped Tim Eyman from charging that Inslee intends to raise taxes.

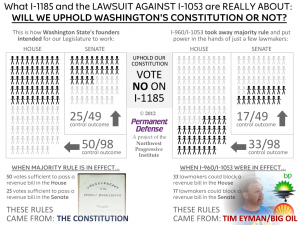

In Eyman’s universe, any action that forestalls a decrease in revenue is really a tax increase, just as the repeal of any tax loophole or exemption is a tax increase. It is worth remembering that Eyman’s own unconstitutional, undemocratic initiatives use his definition for what a tax increase is.

And since I-960/I-1053/I-1185 are regrettably on our books, the Office of Financial Management is using Eyman’s definition – because Eyman’s own initiative requires them to! From Section 2 of I-960:

(1) For any bill introduced in either the house of representatives or the senate that raises taxes as defined by RCW 43.135.035 or increases fees, the office of financial management must expeditiously determine its cost to the taxpayers in its first ten years of imposition, must promptly and without delay report the results of its analysis by public press release via email to each member of the house of representatives, each member of the senate, the news media, and the public, and must post and maintain these releases on its web site. Any ten-year cost projection must include a year-by-year breakdown. For any bill containing more than one revenue source, a ten-year cost projection for each revenue source will be included along with the bill’s total ten-year cost projection. The press release shall include the names of the legislators, and their contact information, who are sponsors and co-sponsors of the bill so they can provide information to, and answer questions from, the public.

We can see from this provision of I-960 that the initiative also stupidly requires OFM to do ten-year cost projections. As our friends at the Washington Budget & Policy Center have pointed out on several occasions, these projections are worthless. By Eyman’s logic, a police lieutenant in NPI’s hometown of Redmond will make more than half a million dollars — over the next ten years.

During the 2010 legislative session, the Legislature raised revenue by around $600 million per year. And a substantial chunk of that is actually set to expire this year. So Eyman’s billion-dollar figures are bogus.

Eyman loves to talk about – and distort – the revenue side of the equation when it comes to the state budget. But he almost never talks about the value side. It often seems as though Eyman would like us all to believe the membership dues we pay as citizens of this great state of Washington just disappear into the ether.

In reality, our taxes provide for roads, bridges, ferries, buses, rail transit, libraries, parks, pools, schools, universities, police and fire protection, clean drinking water, and waste treatment, as well as mental health counseling, housing, and other human services for the most vulnerable among us.

And that’s just the abridged version of what is a long list.

We all benefit from these public services, Tim Eyman included. And we all lose when draconian cuts result in services being eviscerated or eliminated. Austerity measures are bad for public health, bad for environmental freedom, bad for safe neighborhoods, and bad for economic security. Austerity measures lead to lost jobs in the public sector and start a chain reaction that causes real GDP to fall by an amount larger than the total amount of money they “save”. (Those reading who have studied macroeconomics know this concept is known as the multiplier effect).

Eyman’s initiatives are purposely written to deprive our common wealth of the revenue that our public services need to stay in strong shape.

In his early days, Eyman hawked schemes that slashed revenue directly; but he has since taken to heart a famous saying of Grover Norquist’s: “I’m not in favor of abolishing the government. I just want to shrink it down to the size where we can drown it in the bathtub.” That’s why his more recent initiatives take a death-by-a-thousand-cuts approach to wrecking state and local government.

Eyman tries to make it sound as though state government is some monstrous beast consuming more and more of our money with every passing year. But this is a fiction. State and local taxes per $1,000 of personal income have actually been on the decline since before the the Great Recession hit, as the Office of Financial Management shows on this page, complete with a chart that also shows the fifty state average.

In 1995, state and local taxes per $1,000 of personal income hit a high of $119.93. In 2010, the most recent year for which data was available, the figure stood at $94.48. That’s a decrease, not an increase, and a fairly significant decrease over fifteen years.

What about expenditures? Well, again, contrary to Tim Eyman’s hyperbolic rhetoric, expenditures have not been on a meteoric rise. State and local government expenditures per $1,000 of personal income have risen and declined slightly at times over the past two decades, but expenditures today are lower than they were in the early nineties. Here’s the data from OFM, again with a nifty chart.

Twenty years ago, in 1993, state expenditures stood at $224.37 per $1,000 of personal income. That was the high point during the last two decades. In 2010, the most recent year for which data was available, the figure was $200.42.

Again, that’s a decrease, not an increase.

Furthermore, since 2000, Washington’s average has tracked the fifty-state average.

How revenues and expenditures are measured matters. By presenting information in absolute terms, Tim Eyman can make it seem as though government just keeps taking more and more of our money. But the truth is that we the people are the government, and we have reduced our obligations to each other over the last twenty years.

Washington is not the same state it was in 2003, 1993, or 1983. As our economy has grown, so has the demand for public services. The state may be taking in more revenue than it did not long ago in absolute terms, but in relative terms, it’s not. And data cannot be fairly or meaningfully compared year-to-year in absolute terms; as the oft-used expression goes, it’s like comparing apples to oranges.

Ten years ago was a different time; twenty years ago was a different time. Even last year was a different time. We have to compensate for population growth, new development, inflation, and other factors when we consider what it costs to provide services now versus what it cost back then. That’s why it makes sense to look at revenue and expenditures per $1,000 of personal income.

It is beyond ironic that Tim Eyman is accusing newly inaugurated Governor Jay Inslee of “employing political spin”. Nobody is better at generating spin and manipulating the media in Washington than Tim Eyman, who shows no signs of wanting to call it quits after more than a decade of promoting initiatives… and profiting from them.