2004: Initiative 892 | Overview

Summary: I-892 was a 2004 initiative fronted by Tim Eyman on behalf of the gambling industry. It would have resulted in the biggest expansion of gambling in Washington State history by allowing electronic slot machines to be installed in bars, bowling alleys, non-tribal casinos, and other establishments. State revenue generated by the gambling expansion would have been used to cut property taxes. I-892, which Permanent Defense fiercely opposed, was overwhelmingly rejected by Washington voters, and ranks as one of Eyman’s biggest defeats ever, behind only I-517.

On the ballot

| Ballot Title: | Initiative Measure No. 892 concerns authorizing additional “electronic scratch ticket machines” to reduce property taxes. This measure would authorize licensed non-tribal gambling establishments to operate the same type and number of machines as tribal governments, with a portion of tax revenue generated used to reduce state property taxes. | |

| Filed on: | March 23rd, 2004 | |

| Before Voters In: | November of 2004 | |

| Sponsor: |

Tim Eyman | |

| Fate: | Failed | |

| Election Results: | Yes: 38.45% (1,069,414 votes) | No: 61.54% (1,711,785 votes) |

| Election Turnout: | 82.23% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | This measure would authorize licensed gambling establishments (charities, restaurants, taverns, bowling alleys, horse racing facilities, and card rooms) to operate “electronic scratch ticket machines” of the same type, and in the same total number, as authorized in state-tribal gaming compacts. Each licensee would keep 65% of the net win. Of the remaining amount, the state would cover administrative expenses, use 1% to address problem gambling, and use the remainder to reduce the state property tax. | |

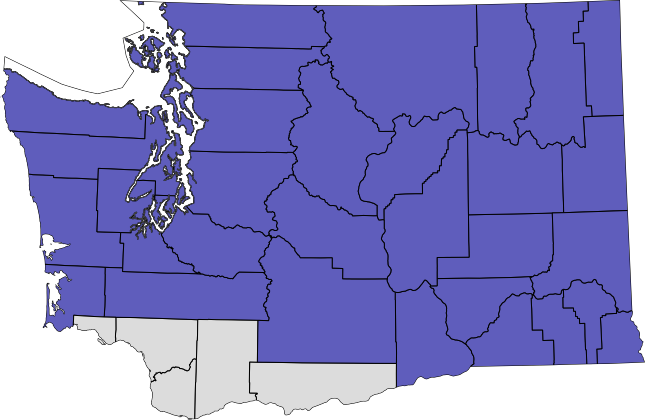

I-892 County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in XLS)

Financing

Please note: JavaScript is required to view this chart.

Data: Public Disclosure Commission | Chart: Northwest Progressive Institute

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 2004 general election.

The law as it presently exists:

The Washington State Lottery Commission was created by state law in 1982. The Lottery Commission is authorized to conduct several types of lottery, including “scratch ticket” lotteries in which printed tickets are sold, each with a cover concealing information as to whether the holder of the ticket has won a prize. The ticket holder discovers whether the ticket bears a prize by scratching the cover off. The tickets are distributed in large sets, with the winning tickets randomly scattered through each set, and sold through various business establishments.

Scratch ticket lotteries can be readily adapted for electronic play, so that in lieu of purchasing a physical ticket, the player “scratches” information displayed through graphics on a computer screen. The Lottery Commission has discretion to determine the types of lottery conducted, but cannot use electronic or mechanical devices or video terminals which allow for individual play against such devices or terminals. (This description bans traditional slot machines and similar devices.) Up to the present time, the state lottery has not conducted electronic versions of its scratch ticket games.

The revenue from the state lottery is used for various state and local public purposes after payment of prizes, agent fees, and administrative expenses. The Lottery Commission has supervisory authority over agents distributing and selling lottery tickets or conducting lottery games, but does not otherwise regulate gambling activity.

The Horse Racing Commission is a state agency with authority to permit and regulate horse racing. Horse racing establishments are permitted to operate certain pari-mutuel betting activities, which are regulated by the Horse Racing Commission.

The State Gambling Commission was created by the Gambling Act in 1973. The Gambling Commission does not directly conduct any gambling, but regulates and enforces state law against private entities that conduct gambling activities. The Gambling Act authorizes several specified types of gambling, but prohibits slot machines and certain other gambling devices. The Gambling Act does not authorize any private party to conduct a “scratch ticket” lottery.

A federal law, the Indian Gaming Regulatory Act (IGRA), defines the forms of gaming (gambling) which may be conducted by federally recognized Indian tribes. For most types of gambling, a tribe may conduct an activity if the activity is permitted anywhere within the state in which the tribal land is located. Under federal law, states must negotiate concerning any form of gaming permitted within the state, and the tribes are not subject to state law restrictions on the time, place, or manner of play. The federal law encourages states and tribes to negotiate compacts (agreements) defining the extent of tribal gaming, and provides appeal procedures if the tribe and state cannot reach agreement. A number of tribes based in Washington have negotiated compacts permitting the tribes to conduct electronic versions of “scratch ticket lottery” games. Electronic scratch ticket machines can be built to visually resemble slot machines, but their internal operation is significantly different from true slot machines. Each Washington tribe operating electronic scratch ticket lottery machines has a compact with the state specifying the number of machines which may be operated and otherwise defining how, when, and where such activities may occur. Tribal gaming revenue must be used for tribal government operations, providing for the general welfare of the tribe, promoting economic development, donations to charity, or funding operations of local government agencies.

The state levies a property tax for the benefit of the common school system. The statutory rate is $3.60 per thousand dollars of assessed value upon the assessed valuation of all taxable property within the state. The Department of Revenue is responsible for adjusting this rate in each county to reflect a statewide equalization of property tax rates. Existing law limits increases in the state property tax levy to the lesser of 101% of the highest amount levied in the three previous years or the inflation rate for personal consumption expenditures as determined by the U.S. Department of Commerce.

The effect of the proposed measure, if it becomes law:

This measure would authorize non-tribal gambling establishments to operate electronic scratch ticket gambling machines of the same type as authorized in state-tribal gaming compacts. The term “non-tribal gambling establishments” would include any establishment licensed by the Gambling Commission to conduct a gambling activity, or any establishment licensed by the Horse Racing Commission. The total number of machines authorized for the non-tribal establishments would be equal to the total number of machines authorized for tribes in state-tribal compacts.

The measure would direct the Lottery Commission to operate an electronic scratch ticket lottery in which non-tribal gambling establishments could participate through the installation of electronic scratch ticket machines (player terminals) in the businesses where they are authorized to conduct other gambling activities. The largest 40 operations conducting bingo games and the largest house-banked card rooms would be authorized to use 125 player terminals per licensed location. Other establishments would be allocated smaller numbers of terminals as described in the measure. The Lottery Commission would regulate the conduct of the lottery, including the allocation of terminals to individual licensees.

The measure would require that the prizes to the holders of winning tickets or shares in the lottery be at least 75% of the gross annual revenue from electronic scratch ticket games. The remainder of the revenue would be defined as the “net win.” Of this net win, 65% would be retained by the individual licensee. The remainder would be placed in an electronic scratch ticket account. Thus, at least 75 cents of each dollar of electronic scratch ticket revenue would be paid out as winnings, 16 cents could be retained by the licensee, and the remainder (about 9 cents) would be placed in the electronic scratch ticket account.

Of the money placed in the account, the Lottery Commission would be authorized to use amounts reasonably necessary to administer the electronic scratch ticket games, the central computer used in the games, and related accounting and auditing functions. After deduction of administrative expenses, the money in the electronic scratch ticket account would be further allocated as follows. One percent (1%) would be dedicated exclusively for distribution to a contractor to pay for services associated with problem gambling. The remaining 99% would be transferred to a special account in the state treasury named the “equal treatment equals lower property taxes account.” Beginning with the state property tax levy for collection in the year 2007, the total state property tax levy would be reduced by the previous year’s gross deposits in this account.

Play of electronic scratch ticket games would be restricted to players 21 years old or more. Electronic scratch ticket licenses could not be issued to convenience stores or other locations readily accessible to minors. Sales would be limited to establishments licensed to conduct other gambling activities, and establishments losing their gambling licenses would also lose their licenses to participate in the electronic scratch ticket lottery. The Lottery Commission would be authorized to establish rules governing the conduct of the electronic scratch ticket lottery.

Source: Archived Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2004 general election.

Summary of Fiscal Impact

Initiative 892 would allow non-tribal establishments including horseracing tracks, bingo games, punch board and pull-tab operators to operate electronic scratch ticket terminals connected to a central system operated by the state Lottery. The number of terminals cannot exceed the number authorized for tribes. A 35 percent state tax is imposed on the net win from the terminals. Ninety-nine percent of the tax would be used to reduce the state property tax levy beginning in 2007 after deducting the state Lottery’s system costs. In 2009 the state levy is reduced by $252 million, saving taxpayers $32 per $100,000 of property value.

FISCAL IMPACT ASSUMPTIONS

Assumptions for Analysis of I-892

- Initiative 892 would task the state Lottery Commission with creating a statewide system and infrastructure for conducting centralized electronic scratch ticket games.

- The Lottery Commission would issue a license to sell or distribute electronic scratch tickets to licensed non-tribal gambling establishments licensed by the state Gambling Commission or the state Horse Racing Commission and subject to their oversight and enforcement. Licensed non-tribal gambling establishments include non-profit charities, restaurants, taverns, bowling alleys, horse racing facilities, and state-regulated, licensed Phase II house-banked card rooms.

- Establishments other than these cannot be licensed for electronic scratch ticket terminals. Electronic scratch ticket terminal licenses could not be issued to agents registered to sell lottery tickets in venues such as convenience stores or other locations readily accessible to minors.

- Licensed non-tribal gambling establishments would be allocated the same type and number of electronic scratch ticket machines, up to a total of 18,225 machines that may operate under compacts with the state.

- Prizes would not be less than 75 percent of the gross annual revenue from electronic scratch ticket games.

- The measure would impose a 35 percent tax on the net win from electronic scratch ticket machines operated by licensed non-tribal gambling establishments. Licensees would keep 65 percent of the net win.

- Proceeds from the state tax would be deposited in the Electronic Scratch Ticket Account. The Lottery Commission would fund administration of the electronic scratch ticket games, central computer, accounting and auditing systems, from the account.

- After deduction of the Lottery Commission’s expenses for operating the system, 99 percent of the proceeds of the state tax would be deposited in the Equal Treatment Equals Lower Property Taxes Account. All revenues in the account must be used to reduce the subsequent year’s state property tax levy.

- The state property tax levy in 2007 and each subsequent year would be reduced from the amount that otherwise would have been levied by an amount equal to the previous year’s deposit in the Equal Treatment Equals Lower Property Taxes Account.

- The remaining one percent of the amount in the Electronic Scratch Ticket Account would be dedicated for distribution to a contractor that will address problem gambling issues.

- The fiscal analysis assumes that 500 new scratch ticket terminals could be in place by January 2006. Total deployed terminals would rise to 13,100 by July 2006 and to 18,225 by January 2007.

- Expected net revenue per machine is assumed to be about $112 per operating day.

In-Depth Analysis

This paper has been prepared by the Office of Financial Management (OFM) in response to questions concerning the financial impact of Initiative 892, which has qualified to appear on the November 2004 ballot. Information is provided for analytical purposes only and is not intended as an expression of support for or opposition to the proposed measure.

Background

Under current law there are several forms of legal gambling in Washington, including:

- Pari-mutuel betting on horse racing at a licensed racetrack, a licensed “satellite” location offering live telecasts, or over the phone or internet through a licensed advanced deposit wagering system. Horse racing is regulated by the state Horse Racing Commission

- Certain forms of gambling, including bingo, raffles, and “Reno nights” for fund-raising to benefit bona fide charities. This gambling is regulated by the state Gambling Commission.

- Card games, punchboards, and pull-tabs as a “commercial stimulant” at food-and-drink establishments. Some establishments offering card games are licensed to offer “house-banked” games played against the establishment rather than other players. These establishments are known as “enhanced card rooms” or “mini-casinos.” Punchboard games, pull-tab games, and card rooms are regulated by the state Gambling Commission.

- Various ticket-based and electronic games operated by the state Lottery Commission to raise revenue. Probably the best known of these games are the lotto-style games that include Lotto and the Mega Millions. The Lottery Commission offers several other lotto-like games, including Quinto, Lucky for Life, Keno, and the Daily Game, where players choose a series of numbers, or playing cards in the case of Quinto. Prizes for these lotto-like games are typically smaller than for Lotto and Mega Millions. The largest revenue-producing product offered by the Lottery Commission is their scratch ticket games. Between 50 and 60 percent of Lottery Commission revenues are generated by scratch ticket games.

- Various games in 19 casinos operated by federally recognized Native American tribes under compacts with the state, as mandated by the federal Indian Gaming Regulatory Act (IGRA). Eight more tribes have compacts with the state but do not yet have casinos. IGRA requires states to negotiate in good faith to allow tribes to conduct, on tribal trust land, any form of gambling that state law allows anyone else to conduct. Tribal casinos offer card and dice games, roulette, bingo, off-track horse betting in some cases, and “electronic scratch ticket” machines that look and feel like slot machines. Compacts authorize 18,225 machines (675 per tribe), though only about 15,000 are currently in operation. Tribes can lease machines to each other, up to a limit of 2,000 machines per tribe. Tribal casinos are regulated by the tribes in cooperation with the state Gambling Commission, and by the National Indian Gaming Commission.

Analysis

Initiative 892 tasks the state Lottery Commission with creating a statewide system and infrastructure for conducting centralized electronic scratch ticket games. The system must include a manufacturing computer, a central computer system and a central accounting and audit computer system. The manufacturing computer securely creates an electronic scratch game set for each active electronic scratch game. The game set is the finite set of electronic scratch tickets that has been designed for each game using a specific set of rules. The central computer system stores the electronic scratch game sets and dispenses the electronic scratch tickets by conducting random drawings from the player-selected electronic scratch ticket game. The central accounting and audit computer system provides a secure means to monitor, receive, store and access data, and record critical functions and activities of the player terminals.

Electronic scratch game licensees will either lease or purchase electronic scratch ticket game player terminals to hook into the Lottery’s centralized system. Electronic scratch ticket game player terminals would be required to operate on the central computer and be linked to the central accounting and auditing computer system. Licensees for electronic scratch tickets may own and operate the player terminals as long as the equipment meets certification requirements. The electronic scratch ticket game player terminals are required to use a cashless transaction system, such as a debit card system. Player terminals are prohibited from accepting or dispensing cash, coins, paper currency or tokens.

Licensed non-tribal gambling establishments are establishments licensed by the state Gambling Commission or the state Horse Racing Commission and subject to their oversight. Licensed non-tribal gambling establishments include non-profit charities, restaurants, taverns, bowling alleys, horse racing facilities, and state-regulated, licensed phase II house-banked card rooms. The Lottery Commission will issue a license to sell or distribute electronic scratch tickets only if the licensee has a valid license to operate bingo, or punch boards or pull-tabs, operate social card games, or is a horse racing facility. Establishments other than these cannot be licensed for electronic scratch ticket terminals. Electronic scratch ticket terminal licenses shall not be issued to agents registered to sell lottery tickets in venues such as convenience stores or other locations readily accessible to minors. An applicant for an electronic scratch ticket license must have maintained a valid license for bingo, punch boards or pull-tabs, operating social card games, or have been a valid horse racing facility for six consecutive months preceding issuance of an electronic scratch ticket license.

Licensed non-tribal gambling establishments are allocated the same type and number of electronic scratch ticket machines as tribal casinos may operate under compacts with the state, currently 18,225. The total number of machines for non-tribal establishments cannot to exceed the total allocated for tribal casinos. On January 1 st of each year beginning with 2005, the initial allocation of terminals is determined. The top 40 gross receipts charitable or nonprofit operations conducting bingo games are allocated 15 percent of electronic scratch ticket machines. Thirty-six percent of the machines are allocated to house-banked card rooms operating at least five house-banked card tables and to horse racing facilities. The top 40 gross receipts charitable or non-profit organizations conducting bingo games, house-banked card rooms operating at least five house-banked card tables and horse racing facilities can each have a maximum of 125 terminals. The remaining 49 percent will be distributed to all other establishments operating bingo games, punch boards, or pull-tabs based on annual gross gambling receipts. In this last category no establishment will receive less than four player terminals.

Prizes shall not be less that 75 percent of the gross annual revenue from electronic scratch ticket games. The state will impose a 35 percent tax on the net win from electronic scratch ticket machines operated by licensed non-tribal gambling establishments. Licensees will keep 65 percent of the net win. Proceeds from the state tax will be deposited in the Electronic Scratch Ticket Account. The Lottery Commission will fund administration of the electronic scratch ticket games, central computer and central accounting and auditing systems from the Electronic Scratch Ticket Account.

After deduction of the Lottery Commission’s expenses for operating the system, 99 percent of the proceeds of the state tax are deposited in the Equal Treatment Equals Lower Property Taxes Account, created by the initiative. All revenues in the account must be used to reduce the subsequent year’s state property tax levy. The state property tax levy in Calendar Year 2007 and each subsequent year will be reduced from the amount that otherwise would have been levied by an amount equal to the previous year’s deposit in the Equal Treatment Equals Lower Property Taxes Account.

Initiative 892 intends that the revenues for support of the common schools not be reduced because of the reduction in revenues from the state property levy.

The remaining one percent of the amount in the Electronic Scratch Ticket Account will be dedicated for distribution to a contractor to address problem gambling. The state Department of Social and Health Services must contract with a non-profit entity incorporated in Washington to provide public awareness, education, prevention, helpline services, treatment, professional training, counselor certification, research and other services necessary to address problem gambling in Washington to implement a program that addresses problem gambling.

Play of all electronic scratch ticket games is restricted to players who are twenty-one years of age or older. Placement of terminals is only allowed on premises and in areas of premises where persons twenty-one years of age or older are permitted. Each licensed gambling establishment must conspicuously display an estimate of the probability of purchasing winning electronic scratch game tickets at the facility. The Lottery Commission must require a label on each terminal that prominently displays the Washington problem gambling helpline number.

Fiscal Impact

Fiscal estimates are based on staged deployment of 18,225 electronic scratch ticket terminals. The Lottery Commission expects that the centralized system necessary to run the statewide electronic scratch ticket system would be ready by the end of 2005. Based on that time frame, the Lottery Commission assumes that 500 terminal could be in place by January 2006. Total deployed terminals would rise to 13,100 by July 2006 and 18,225 by January 2007. Expected net revenue per machine is assumed to be about $112 per operating day. Total prizes are assumed to be the minimum 75 percent of gross annual revenue from electronic scratch ticket games as required in the Initiative.

Given these assumptions, revenues and distributions of revenues from Initiative 892 are as follows:

Revenues from Initiative 892 (view as pdf) Revenue in $ millions CY 2006 CY 2007 CY 2008 CY 2009 Net Revenue 277.0 690.3 742.5 742.5 Distribution of Net Win Licensees @ 65% 180.1 448.7 482.6 482.6 State tax @ 35% 97.0 241.6 259.9 259.9 Distribution of state tax Lottery operating expenses 5.5 5.1 5.3 5.3 Property tax reduction @ 99% 90.6 234.1 252.0 252.0 Problem gambling @ 1% 0.9 2.4 2.5 2.5 Revenues from the state tax placed in the Equal Treatment Equals Lower Property Taxes Account will be used to reduce the state property tax levy starting in Calendar Year 2007. The effects of the reduction on the state levy and the state levy rates are shown below:

Change in State Property Tax Levy from Initiative 892 (view as pdf) State Levy in $ millions; Rates in dollars per $1,000 of market value of property State Levy before I–892 State Levy Reduction from I–892 State Levy after I–892 State Levy Rate before I–892 State Levy Rate after I–892 CY 2006 $1,629.4 $0.0 $1,629.4 $2.50 $2.50 CY 2007 1,680.0 90.6 1,589.4 2.43 2.30 CY 2008 1,731.7 234.1 1,497.6 2.34 2.03 CY 2009 1,783.1 252.0 1,531.1 2.28 1.96 Property tax savings on property with market value of $100,000 will be approximately $13 in Calendar Year 2007. Once the deployment of electronic scratch ticket machines is completed savings will rise to $32 per year for property with market value of $100,000 in Calendar Year 2009.

Electronic scratch ticket games may compete with Lottery Commission products as well as other gaming and entertainment options for consumer spending. Electronic scratch tickets are modeled after paper scratch tickets and are likely to directly compete with the Lottery’s paper scratch ticket products. The Lottery Commission estimates that sales of its products will be reduced by up to 25 percent if those products are not sold in the same venues where there are electronic scratch ticket machines. Currently, Lottery Commission products are not sold in the venues that would be eligible to receive electronic scratch ticket machines. If the competition from electronic scratch tickets reduces the sales of Lottery Commission products by 25 percent, Lottery revenue deposited in the Education Construction Account would be reduced by $19.3 million in the 2005-07 Biennium and $60.0 million in the 2007-09 Biennium. The Lottery Commission estimates that sales of its products will be reduced by up to 13 percent if those products are sold in the same venues where there are electronic scratch ticket machines.

Electronic scratch ticket games are also likely to compete with other gaming products like pull tab and punch board games. Cities, towns and counties have statutory authority to tax punchboard and pull tab games as well as bingo, raffles, social card games and amusement games. The state Gambling Commission estimates that local gambling tax revenues might decline by as much as $7.5 million in 2007 as electronic scratch card games are being implemented. Losses could grow to $8.4 million in 2008 and in 2009.

Appendix: Supplemental Tables

The following tables are presented in Adobe PDF format.

Source: Archived Washington State Voter’s Pamphlet; Archived OFM website

Voter’s pamphlet argument against I-892

The following is the text of the argument that appeared in the 2004 voter’s pamphlet urging a no vote on I-892, including the rebuttal.

I-892 is a bad bet for Washington. Gambling would double – as would the social problems associated with gambling. Washington would be in the same gambling league as big casino states like Nevada, Mississippi and New Jersey.

ELECTRONIC SCRATCH TICKET MACHINES ARE REALLY ELECTRONIC SLOT MACHINES

The ballot title says “electronic scratch ticket machines,” but don’t be deceived. I-892 legalizes Las Vegas-style electronic slot machines.

I-892 would allow 18,000 new slot machines in 2,000 neighborhood restaurants, bowling alleys, bingo halls, card rooms and other establishments.

I-892 WOULD BRING ELECTRONIC SLOT MACHINES INTO OUR NEIGHBORHOODS AND WOULD HURT SMALL BUSINESSES

Las Vegas-style gambling would be allowed near schools, malls, libraries, churches and other areas where children gather.

Cities that ban most gambling could find their laws over-ridden and slot machines in their neighborhood establishments.

Gambling hurts small businesses when consumers spend money at casinos instead of at neighborhood shops and restaurants.

ELECTRONIC SLOT MACHINES HURT KIDS AND FAMILIES

Kids pay the consequences when parents suffer from gambling addictions.

Experts say that expanding gambling opportunities increases the number of problem gamblers.

Domestic violence, child neglect, divorce, theft, and substance abuse are strongly associated with problem gambling.

I-892 PROFITS OUT-OF-STATE GAMBLING COMPANIES, BUT IT WOULD COST WASHINGTON TAXPAYERS MILLIONS

Foreign and out-of-state gambling corporations are promoting I-892 and would reap huge profits.

Taxpayers would foot the bill for the millions associated with increased crime, bankruptcies, and treatment of gambling addictions.

We already have more than enough gambling opportunities in Washington. It’s time to say “no” to the big gambling interests. Our quality of life is at stake.

I-892 is a bad bet for Washington. It’s bad for kids, bad for families, bad for neighborhoods, bad for taxpayers, bad for small businesses. Vote no on I-892.

REBUTTAL OF ARGUMENT FOR: I-892 is built on deception. It says “electronic scratch ticket machines,” but it means slot machines in neighborhoods.

Gambling always over-promises and under-delivers. Remember – the Lottery was supposed to pay for education?

I-892 claims that taxpayers will save, but sends most of the profits out-of-state. The gambling companies take a 65% profit, while the problems stay here. After administration and problem gambling costs, who knows what will be left for a tax cut?

ARGUMENT PREPARED BY: REV. JOHN BOONSTRA, Executive Director, Washington Association of Churches; JEAN GODDEN, former PTA leader and journalist; JOHN LADENBURG, Pierce County Executive, former prosecutor; NORM MALENG, King County Prosecutor; SID MORRISON, Yakima farmer and businessman, former member of Congress; SHARON TOMIKO SANTOS, Asian community leader, State Representative, 37th Legislative District.