2000: Initiative 745 | Overview

Summary: I-745 was a Tim Eyman initiative financed by the asphalt paving industry that appeared on the November 2000 ballot. It attempted to force the Washington State Department of Transportation to spend ninety percent of its funds (including revenue collected for transit) on road construction. Voters overwhelmingly rejected it, handing Tim Eyman his first loss at the ballot. The NO coalition included over eighty organizations, including the Washington State Labor Council, Washington State Council of Firefighters, League of Women Voters, American Planning Association, Greater Seattle Chamber of Commerce, Association of Washington Business, Washington Conservation Voters and Puget Sound Council of Senior Citizens.

On the ballot

| Ballot Title: | Shall 90% of transportation funds, including transit taxes, be spent for roads; transportation agency performance audits required; and road construction and maintenance be sales tax-exempt? | |

| Filed on: | May 3rd, 2000 | |

| Before Voters In: | November of 2000 | |

| Prime Sponsor: |

Tim Eyman | |

| Fate: | Failed | |

| Election Results: | Yes: 40.65% (955,329 votes) | No: 59.34% (1,394,387 votes) |

| Election Turnout: | 75.46% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | This measure would require that 90% of state and local transportation funds, including local transit taxes but excluding ferry and transit fares, be spent on road construction, improvement, and maintenance. Road and lane construction and maintenance would be the top transportation priority. Performance audits of transportation and public transit agencies would be required. Materials and labor used in road construction or maintenance would be exempt from sales tax. Counties and cities would update transportation plans. | |

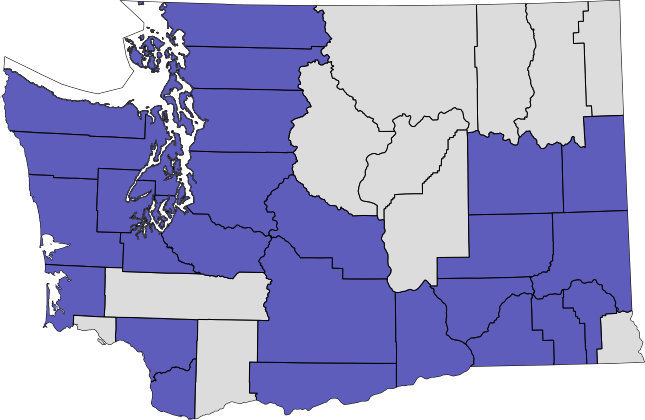

I-745 County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in DOC)

Financing

Please note: JavaScript is required to view this chart.

Data: Public Disclosure Commission | Chart: Northwest Progressive Institute

Total Raised: $1,547,800

- Cash Contributions: $707,600

- In-kind Contributions: $20,000

- Loans: $670,100

Total Spent: $1,547,751.30

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 2000 general election.

The Law As It Presently Exists

Under existing law, transportation is the responsibility of both state and local governments. The state department of transportation constructs and operates a system of state highways. In addition, the department operates the state ferry system and provides support for rail transportation and some small airports in the state. Counties and cities construct and maintain their own systems of roads and streets. Counties and cities also have authority to operate ferry and public transit systems. Special purpose districts have been created to operate public transit and rail systems on a local or regional basis. Each of these governments operates with funds derived from taxes or from user fees (such as ferry and bus fares) in various proportions.

The state auditor presently conducts periodic audits of all state and local agencies to ensure their compliance with the constitution and laws of the state, with local ordinances, and with applicable accounting practices (RCW 43.09). These audits are not “performance audits” as that term is generally understood. The Joint Legislative Audit and Review Committee, a legislative committee, has legal authority to conduct performance audits of state agencies or of local governments receiving state funds (RCW 44.28).

Materials, labor, and services used in the construction or maintenance of state-owned roads, streets, highways, places, easements, rights of way, mass public transportation terminals and parking facilities, bridges, tunnels, and trestles are presently subjected to the retail sales tax (RCW 82.08) and use tax (RCW 82.12). In addition, materials (but not labor and services) used in the construction or maintenance of other publicly owned roads, streets, highways, places, easements, rights of way, mass public transportation terminals and parking facilities, bridges, tunnels, and trestles are presently subjected to retail sales tax and use tax. Contractors pay sales tax on materials and labor used in construction projects on facilities owned and operated by the federal government.

The Effect of the Proposed Measure Should It Be Approved Into Law

This measure would declare that new road and lane construction and road maintenance would be the state’s top priority for transportation system improvements. The measure would direct the legislature, in consultation with local governments, to adopt implementing legislation which would require a minimum of 90% of transportation funds to be spent on construction of new roads, new lanes on existing roads, improvements to the traffic carrying capacity of roads, or maintenance of roads. The term “transportation funds” would include state and local government funds spent for transportation purposes, including the transportation fund, the highway fund, public transit and ferry operating accounts and reserves, public transit and ferry capital accounts and reserves, local government transportation accounts, public transportation authorities, transportation benefit districts, and the amounts placed in the high occupancy vehicle account (RCW 81.100.070). It does not include federal funds specifically provided for non-roadway purposes, transportation vehicle funds used by school districts, funds used by airports or port districts, or the fares paid by customers of transit and ferry systems. The term “roads” would include all publicly owned roads, streets, and highways.

The measure would also require a performance audit on each transportation agency, account, and program, including the state department of transportation, the state ferry system, and all public transit agencies. The first audit report for each agency would be submitted by December 31, 2001, and subsequent performance audits would be conducted as determined necessary by the state auditor. Transportation funds would be used to pay for the performance audits.

The measure would exempt, from sales and use taxes, materials and labor used in the construction or maintenance of publicly owned roads, streets, and highways.

The measure would also require the updating of comprehensive plans developed under Chapter 36.70A RCW (the growth management act) and the six-year transportation plans required by RCW 44.40.070, to reflect the provisions and priorities of this measure.

Source: Archived Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2000 general election.

THIS PAPER HAS BEEN PREPARED by the Office of Financial Management and the House and Senate Transportation Committees in response to questions concerning the provisions and impact of Initiative 745, which has been certified to appear on the November 2000 general election ballot. The information is provided for analytical purposes only and is not provided as an expression of support for or opposition to the proposed measure.

Ballot Measure Summary

Initiative 745 would require that 90% of state and local transportation funds, including local transit taxes but excluding ferry and transit fares, be spent on road construction, improvement, and maintenance. Road and lane construction and maintenance would be the top transportation priority. Performance audits of transportation and public transit agencies would be required. Materials and labor used in road construction or maintenance would be exempt from sales tax. Counties and cities would update transportation plans.Background

Washington’s transportation system is an elaborate network of roads, routes, and runways, governed and operated by public and private entities, and supported through a myriad of funding combinations comprised of federal, state, and local taxes and private capital.The state is responsible for planning, maintaining and enhancing 7,047 miles of highways that support over 4 million Washington drivers who drove about 52 billion miles in 1998. Washington operates 16 airports and provides technical and financial assistance to many others. The state operates a fleet of 29 ferries that carry, each year, over 11 million vehicles and 26 million passengers. Its state patrol monitors highways, while other agencies license vehicles, help local governments, and manage traffic safety programs.

Regional and local governments also have significant responsibilities related to the transportation system. Regional transportation planning organizations (RTPOs) review and coordinate city and county land-use and transportation planning. Counties plan, maintain, and enhance 40,495 miles of county roads and cities do the same for 13,499 miles of streets. All city and county governments construct and maintain bridges and trails, while some even operate ferry systems. Twenty-six transit systems, which travel throughout their respective regions, operate fixed-route systems and provide demand-response service. In 1998, these systems provided 156 million passenger trips. Many of them also coordinate vanpool and carpool programs.

Not all of the transportation system is operated by the government, however. Private companies provide intercity bus and commercial air services, and private trucking firms carry vast quantities of consumer goods and raw materials. They also operate freight rail lines, airports, taxicabs and airporters.

The federal government provides significant financial assistance to Washington state for transportation purposes. Before the 1991 Intermodal Surface Transportation Efficiency Act, the federal government’s programs focused on highways. Since then, federal dollars have supported funding of multimodal transportation plans. The Transportation Equity Act for the 21st Century (TEA 21), enacted in 1998, carries forward the ISTEA philosophy and added three new highway discretionary programs.

Policy makers draw upon almost 60 sources of state funds to support their transportation system; the largest is the motor fuel tax, which provides state and local governments with over $700 million per year, dedicated to highway purposes. The Legislature appropriates the state’s share of this tax money in its biennial and supplemental budgets, and the rest is distributed to local jurisdictions by formula. Other sources of state revenue include bond proceeds; licenses, permits, and fees (LPF); and ferry fares, among others.

The Legislature has also given local governments the authority to raise taxes for their own transportation programs.

Initiative 745 – Main Provisions

As summarized above, Initiative 745 directs the legislature, in consultation with local governments, to adopt legislation requiring a minimum of 90% of all transportation funds, including transit taxes, to be spent for construction of new roads, new lanes on existing roads, improvements to traffic capacity of roads, or maintenance of roads. The initiative goes on to define “transportation funds” as all government funds spent for transportation including – but not limited to – the state highway fund, public transit operating and capital accounts, ferry operating and capital accounts and reserves, local government transportation accounts, public transportation authorities, transportation benefit districts, and the high occupancy vehicle account. The initiative does exclude a number of funds from this definition including federal funds that are specifically provided for non-roadway purposes, ferry fares, transit fares. Transportation funds used for school districts, airports, or port districts are specifically excluded.The Initiative charges the state Auditor’s office with conducting performance audits on each transportation agency, account, and program by December 31, 2001. Subsequent performance audits are to be conducted when determined necessary by the state auditor.

The Regional Transportation Authority (i.e., Sound Transit – a bus and commuter-rail mass transit system in the Puget Sound) is directed to make all expenditures for projects, programs and services within its area boundaries. It is not certain whether 90% of the expenditures must be used for roads.

Under the initiative, materials and labor used in the construction or maintenance of publicly owned roads, streets, and highways are exempted from retail sales and use tax.

Counties and cities are directed to update their traffic plans under the Growth Management Act (GMA) to reflect the provisions of I-745 and transportation agencies are directed to reflect the funding priorities of I-745.

Other elements of the initiative include a liberal construction clause, which allows for fewer constraints in legal interpretations; and a severability clause, which protects and preserves sections in the event that other sections are found illegal and severed from the measure. The measure also requires that the Office of Financial Management (OFM) provide annual compliance reports to track the implementation of the initiative.

Assessing Fiscal Impacts of the Initiative

The language of the initiative leaves some definitions unclear, making absolute resolution impossible. The following assumptions were made for purposes of analysis, though they may change with further evaluation or legal decisions should the initiative pass. For the purposes of fiscal analysis, it is assumed that revenues approved by voters for specific purposes other than highway use could be shifted to roads.90% of all Transportation Funds to Roads (Section 2): Two scenarios were developed depending on different definitions of “roads.” The first scenario applies a broad definition of roads equivalent to the term “highway purposes” as used in the 18th Amendment of the Washington State Constitution. In this scenario, ferries and the state patrol fall within the definition of “roads” since they are specifically designated as such in the Constitution. The initiative does not refer to transportation planning but, under this broad interpretation, planning and management would constitute roadway expenditures since new roads could not be built without them.

In the second, narrow definition, the term “road” is limited to those programs that pour, maintain, or preserve paved or gravel surfaces or that manage the movement of motor vehicle traffic upon them.

Transit operations are considered non-road functions throughout the analysis.

It is assumed that maintenance includes preservation. Initiative 745 identifies “maintenance” as an allowed road use. The Washington State Department of Transportation (WSDOT) divides its upkeep of the current system into “maintenance” and “preservation.” For purposes of this analysis, preservation is considered to be within the scope of maintenance.

It is assumed that the 90/10 split is for all transportation funds combined. Based upon a Superior Court brief filed by I-745 proponents in the court action over the initiative title, the 90/10 split mandated by the initiative is apparently intended to apply to all statewide transportation funds considered as a whole. That is, expenditures from a particular fund or jurisdiction would not necessarily have to meet the 90/10 test as long as overall transportation expenditures met the requirement.

No assumption is made about the amount of revenue that might be available in future biennia. However, revenue increases or decreases could dramatically alter how the 90/10 split might be achieved.

In addition to the funds and accounts that are specifically called out, the initiative defines “transportation funds” as “government funds spent for transportation purposes.” It is assumed that all funds appropriated in the 1999-01 transportation budget qualify as “transportation funds.”

It is unclear whether funds collected from a designated group of citizens to provide specific services to that group should be included. For instance, the motorcycle safety education fund consists entirely of fees from motorcycle licenses. The Department of Licensing is required by statute to use those fees to fund a motorcycle safety education program. Other examples include the Highway Safety Fund, the Board of Pilotage Commissioners Account and the Grade Crossing Protective Account. The language of the initiative does not make these definitions clear. For purposes of the attached analysis those funds were included as transportation funds subject to reevaluation should the initiative pass.

Although it is not clear in the initiative, it is assumed that public assistance funds used by the Department of Social and Health Services and the Office of the Superintendent of Public Instruction to provide transportation for clients and/or students are not within the definition of “transportation funds.”

Table 1 Roads Defined, 1999-01 Budgeted/Estimated Expenditures (Excel spreadsheet) demonstrates the funding differences between the broad and the narrow scenarios described above.

There are potentially many ways to achieve the 90% target for spending on roads required by I-745. Assuming that revenues approved by voters for specific purposes could be shifted to roads, achieving the 90% target for 1999-2001 biennium expenditure levels would require shifting between $700 million and $2.0 billion in transportation spending from transit and other “non-road” functions to “road” functions – depending on whether the broad or narrow definition of roads is applied.

Transportation Audits (Section 3): The state auditor is required to conduct performance audits on each transportation agency, account, and program by December 31, 2001. This requirement appears to include local government transportation programs (cities, counties) all public transit agencies, and the transportation programs of state agencies funded within the transportation budget. Transportation funds must be used for the cost of each audit. While the first audit reports must be submitted to the Legislature by December 31, 2001, subsequent audits are at the discretion of the state auditor. The level of effort and cost of each audit will vary depending upon the complexity and risk associated with each agency. A fiscal impact regarding the costs of the audits is currently not available.

Sales and Use Tax Exemption (Sections 4 and 5): The sales and use tax exemption will reduce state revenues by approximately $42 million annually, and local governments’ revenues by $11 million annually. NOTE: The exemption in Sections 4 and 5 could result in the additional loss of $50 million in annual state and local sales tax revenues paid by federal contractors. This potential impact is not included in the above estimates. Part of the rationale by which the U.S. Supreme Court upheld Washington’s 1975 use tax statute extending tax liability to federal contractors is the fact that state and local jurisdictions are subject to the retail sales/use tax.

Attachment A provides additional information regarding the initiative in a question and answer format.

Source: Archived OFM website

Voter’s pamphlet argument against I-745

The following is the text of the argument that appeared in the 2000 voter’s pamphlet urging a no vote on I-745, including the rebuttal.

WASHINGTON STATE HAS A TRAFFIC PROBLEM – I-745 WILL NOT SOLVE IT. I-745 WILL MAKE IT WORSE.

I-745’s 90% for roads is a “one-size-fits all” solution to our state transportation problems that will not work. Real traffic solutions require providing people with choices that include both good roads and good public transportation, including buses, ferries, and rail. Roads are important, but taking the money away from public transportation to fund them will only make traffic worse.

WE NEED CHOICES. PUBLIC TRANSPORTATION IS AN IMPORTANT PART OF THE SOLUTION FOR MANY AREAS.

I-745 dictates that 90% of all transportation funds go to one solution – roads. It also puts politicians and bureaucrats in Olympia in the driver’s seat – giving them control of our local transportation funding. I-745 limits our options. If roads are the only transportation priority, other choices like transit will be severely cut. With less public transportation more people will be forced to drive, putting even more cars on the road. Seniors, disabled people, and those unable to drive will lose their ability to get around.

LOCAL CONTROL IS NEEDED TO SOLVE TRANSPORTATION PROBLEMS – I-745 TAKES AWAY LOCAL CONTROL.

Recently voters in Grays Harbor, Clallam and Island Counties have voted to support public transit as a choice in their community. I-745 would send that money – along with other locally approved funds from around the state – to the State Legislature, to be spent on roads. The will of the voters in those communities would be ignored.

WHO REALLY BENEFITS FROM PASSAGE OF I-745? ASPHALT PAVING COMPANIES – NOT US.

“Washington Citizens for Congestion Relief” was founded by the Asphalt Paving Association of Washington. With help from oil companies, they paid over half a million dollars to buy signatures to get I-745 on the ballot. They will make millions and we will still be stuck in traffic.

REBUTTAL OF STATEMENT FOR

Asphalt pavers bought the signatures to put I-745 on the ballot. Their campaign and their studies make claims that are misleading and inaccurate. Washington’s transportation problems need a solution that includes both road improvements and transportation choices for local communities. I-745’s requirement that all transportation funding be split 90%-10% does not allow us to maintain real transportation choices. That’s why seniors, business, churches, labor, the disabled, and conservation groups, recommend voting No on 745.

ARGUMENTS AGAINST I-745 PREPARED BY…

ELIZABETH PIERINI, Co-Chair, League of Women Voters of Washington; STEPHANIE SOLIEN, Board Chair, Washington Conservation Voters; WILL PARRY, President, Puget Sound Council of Senior Citizens; LOUISE MILLER, Republican, King County Council; RICK BENDER, President, Washington State Labor Council; ROGER BERGH, President, Washington State Good Roads & Transportation Association.