November 18th, 2015

NPI/Permanent Defense founder Andrew Villeneuve files Majority Vote Protection Initiative

Rethinking and ReframingStatements & Advisories

This morning, at the Secretary of State’s office in Olympia, Northwest Progressive Institute founder and Executive Director Andrew Villeneuve filed a new statewide initiative, titled the Majority Vote Protection Act. The intent of the initiative is to ensure that going forward, statewide initiatives and referenda only pass if an absolute majority of the state’s registered voters weigh in on them.

Additionally, the Majority Vote Protection Act stipulates that any initiative that attempts to impose any supermajority vote requirement on the Legislature (whether three-fifths, two-thirds, three-fourths, or some other threshold) must pass by the exact same supermajority of the voters, or else it will be declared failed.

“The team at the Northwest Progressive Institute is very excited about defending our Constitution’s balance of majority rule and minority rights with the Majority Vote Protection Act,” said NPI’s Villeneuve.

“This is the very first draft of this initiative, and we look forward to refining and improving it in response to the feedback we receive from our supporters, the public, and the press. We feel strongly that the time has come to change state law to ensure that our cherished tradition of majority rule is protected.”

“Our Constitution requires that bills in the Legislature pass by an absolute majority, but our minimum threshold for passage of initiatives and referenda is merely a majority of whoever turns out to vote. That doesn’t make any sense.”

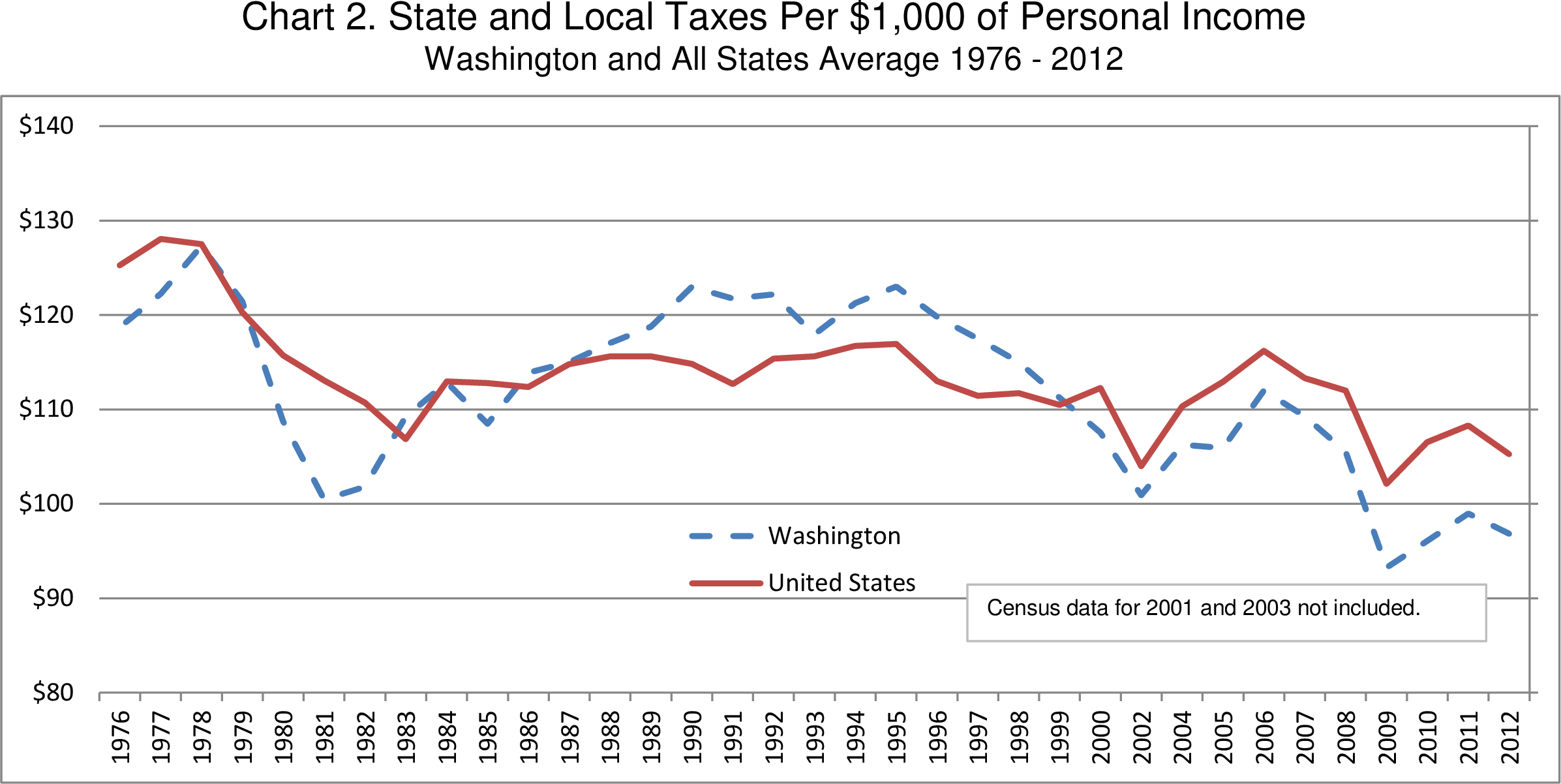

“Under the lax rules of our current system, a small fraction of the state’s electorate can impose laws on everybody else in an election with poor turnout. That is precisely what’s happening right now with Tim Eyman’s hostage-taking I-1366.”

“As of this morning, turnout in Washington’s 2015 general election stands at a measly 38.28%, with almost no ballots left to count. This is the worst general election turnout since the state began permanent voter registration in the 1930s. A little more than half of the voters who participated in this year’s election voted for I-1366, while slightly less than half voted against I-1366. As Seattle Times columnist Ron Judd astutely pointed out in his column The Wrap earlier this month, this means that I-1366 has the support of less than twenty percent of the electorate.”

“A system of government that permits a few to make decisions for the many is not a true democracy,” Villeneuve said. “The first draft of our Majority Vote Protection Act would amend the statute governing the canvass of statewide ballot measures to require that all initiatives and referenda be voted on by at least an absolute majority of registered voters in order to be declared passed. It would also amend the same statute to stop the initiative process from being used to subvert majority rule by requiring that any initiative which contains some incarnation of a supermajority vote requirement to pass by its own supermajority vote requirement — or else be declared failed.”

NPI welcomes feedback on the Majority Vote Protection Act. Questions and comments pertaining to the new initiative draft may be submitted to NPI through Permanent Defense’s contact form.