October 25th, 2019

Debunking Tim Eyman’s I-976 whoppers: Car tabs actually *do* pay for bridges and roads

From the Campaign TrailRethinking and Reframing

The last few years have been littered with setbacks and defeats for disgraced initiative promoter Tim Eyman. From 2016-2018, Eyman failed to qualify anything to Washington’s general election ballot despite half a dozen attempts.

Meanwhile, Attorney General Bob Ferguson’s office has been working tirelessly to hold Eyman accountable for his willful and blatant violations of Washington’s public disclosure laws, dealing Eyman loss after loss in court.

Eyman is counting on an electoral victory in November to revive the fortunes of his flailing initiative factory. He has declared that his Initiative 976, a measure that would gut $4.2 billion in transportation funding over the next six years, will pass overwhelmingly in all thirty-nine of Washington’s counties and even pass in Seattle, which has consistently rejected his destructive schemes for twenty years.

If we look at what Eyman has said in response to questions about I-976’s fiscal impacts, though, we can see Eyman’s not confident about winning in November. Why else would Eyman feel the need to lie about the extent of the damage that his measure would cause?

The whoppers Eyman has been telling about I-976 deserve to be called out and debunked.

In the last three weeks, perhaps out of irritation with Keep Washington Rolling’s television ads, Eyman has aggressively peddled a particularly egregious lie that can be easily demonstrated to be an utter falsehood.

EYMAN CLAIM: “Car tab taxes don’t pay for bridges or roads – gas taxes do.” (Source: Eyman’s Facebook Wall, October 6th, 2019).

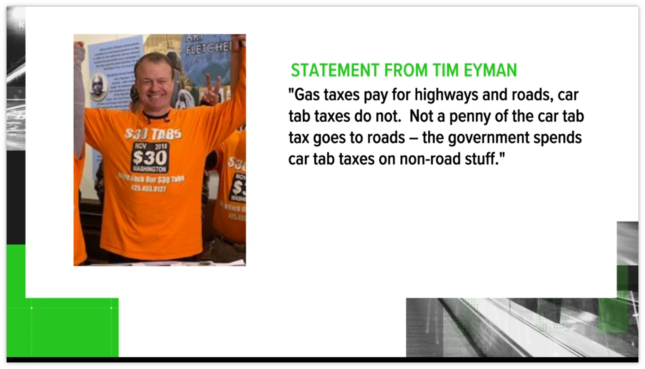

Eyman also repeated this fabrication in an interview with KREM 2 News of Spokane:

Statement from Tim Eyman: “Gas taxes pay for highways and roads, car tab taxes do not. Not a penny of the car tab tax goes to roads — the government spends car tab taxes on non-road stuff.”

Ironically, this lie appeared onscreen during a segment entitled “Verify”. The lie was not subsequently debunked by reporter Tim Pham — though it should have been.

THE REALITY: Vehicle fees — or “car tab taxes”, in Eyman parlance — do in fact pay for bridges and roads. At the state level, many vehicle fees are deposited in accounts that benefit our roads and bridges, including the Motor Vehicle Fund. At the local level, more than sixty cities have formed what are known as transportation benefit districts to levy vehicle fees, primarily for street maintenance and road repairs.

Here’s an example of a Washington State vehicle registration renewal bill, circa 2019:

| Fees and Donations | |

| Registration License – Renewal | $30.00 |

| Vehicle Weight | $25.00 |

| Registration Filing | $4.50 |

| Registration Service Fee | $8.00 |

| License Plate Technology | $0.25 |

| Department of Licensing Service | $0.50 |

| State Parks Donation | $5.00 |

| RTA Excise Tax | $67.00 |

| Total | $140.25 |

Notice the first line item… “Registration License — Renewal”. That thirty dollars benefits the Washington State Patrol, Washington State Ferries, and the Motor Vehicle Fund.

RCW 46.68.035 directs how the funds from that line item are to be invested:

Disposition of combined vehicle license fees.

The director shall forward all proceeds from vehicle license fees received by the director for vehicles registered under RCW 46.17.330, 46.17.350(1) (c) and (k), 46.17.355, and 46.17.400(1)(c) to the state treasurer to be distributed into accounts according to the following method:

(1) 22.36 percent must be deposited into the state patrol highway account of the motor vehicle fund;

(2) 1.375 percent must be deposited into the Puget Sound ferry operations account of the motor vehicle fund;

(3) 5.237 percent must be deposited into the transportation 2003 account (nickel account);

(4) 11.533 percent must be deposited into the transportation partnership account created in RCW 46.68.290; and

(5) The remaining proceeds must be deposited into the motor vehicle fund.

It says right there in the law that vehicle license fees (car tabs) must be deposited in accounts that provide funding for the State Patrol, Washington State Ferries, highway projects authorized by the Legislature, and the Motor Vehicle Fund.

The state’s Motor Vehicle Fund “shall be for the use of the state, and through state agencies, for the use of counties, cities, and towns for proper road, street, and highway purposes,” according to RCW46.68.070. (Emphasis is ours).

State vehicle weight fees, meanwhile, benefit the Freight Mobility Multimodal Account and the main Multimodal Account. These accounts fund all transportation modes, including our highway system as well as the state’s rail initiatives. See RCW 46.68.415.

And most cities levying vehicle fees are using them for street maintenance. Like Spokane, Sedro-Woolley, Prosser, or Vancouver.

So, again, when Tim Eyman says car tabs don’t pay for bridges and roads, he’s lying.

Why does Eyman lie so brazenly?

Because he knows that as satirist Jonathan Swift once observed, a lie can travel halfway around the world while the truth is still putting its boots on.

Eyman’s idol Donald Trump, the Liar-in-Chief, knows this too, and takes full advantage.

At NPI, what we do when we read an Eyman email missive, see an Eyman Facebook posting, or hear a clip of Eyman is speaking is assume that everything Eyman has said is false until it can be proven true. This is not our normal practice; we like to assume that people mean well as opposed to assuming hostile, malicious intent.

But with known con artists like Tim Eyman, it’s absolutely necessary to invert the default.

Otherwise, the con artist succeeds in their aim of conning people.

Our advice to anyone covering I-976 or any of Tim Eyman’s activities is this: Trust nothing Eyman says. Nothing. If you ask Eyman for comment out of fairness, and he lies — as he so often does — call him on it. You can say: “Mr. Eyman told us this, but it’s actually not true… here’s what we found when we followed the facts.”

If media outlets allow Eyman’s lies to go unchecked, they spread. And that’s bad for Washington’s civic health. It promotes cynicism and mistrust in government.

As taxpayers, it’s important we connect the dots between the taxes and fees we pay and the services we get in return. We should all understand the workings of our government to the best of our ability. After all, these services are ours. We pay for them.

They belong to us.