2006: Initiative 933 | Overview

Summary: I-933 was a 2006 pro-sprawl initiative that attempted to require state and local governments to pay landowners for claims of diminished property value due to zoning or environmental rules, or else not enforce those rules at all. Bankrolled by the Farm Bureau and the out-of-state Americans For Limited Government, it was vigorously opposed by Citizens for Community Protection, a broad coalition that included NPI’s Permanent Defense as well as The Nature Conservancy, Affiliated Tribes of Northwest Indians, Greater Seattle Chamber of Commerce, League of Women Voters, Futurewise, the Washington Environmental Council, and many other organizations. Voters overwhelmingly rejected I-933 at the November 2006 general election.

On the ballot

| Ballot Title: | Initiative Measure No. 933 concerns government regulation of private property. This measure would require compensation when government regulation damages the use or value of private property, would forbid regulations that prohibit existing legal uses of private property, and would provide exceptions or payments. Should this measure be enacted into law? | |

| Filed On: | January 24th, 2006 | |

| Before Voters In: | November of 2006 | |

| Sponsor: |

Daniel W. Wood | |

| Fate: | Failed | |

| Election Results: | Yes: 41.2% (839,992 votes) | No: 58.8% (1,199,679 votes) |

| Election Turnout: | 64.55% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | This measure would require government agencies to consider the effects of and alternatives to regulating private property. Compensation would be required when regulations are enforced that damage private property use or value, including regulations prohibiting or restricting property uses that were allowed as of January 1, 1996. Exceptions would exist for regulations applying equally to all property subject to the agency’s jurisdiction. Development regulations that would prohibit existing legal property uses would not be permitted. | |

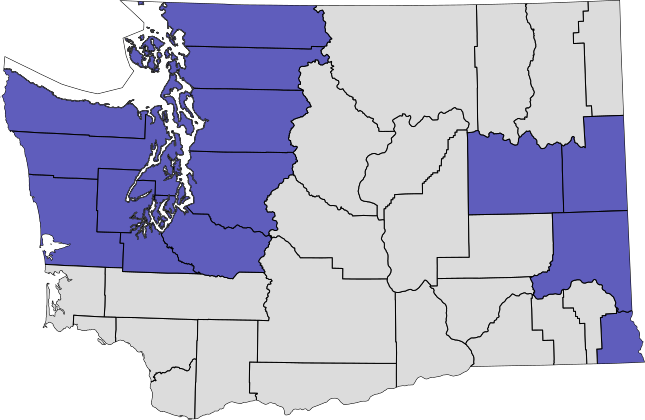

I-933 County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in XLS) or archived elections results map.

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 2006 general election.

The law as it presently exists:

Washington law currently imposes a tax on the transfer of an estate of a deceased person if the taxable value of the estate is at least 2 million dollars. The gross value of a deceased person’s estate includes the value at the time of death of all of the deceased person’s property, real or personal, tangible or intangible, wherever it is located. The taxable estate is determined by subtracting two million dollars, and various deduction amounts allowed under state law, from the gross value of the estate. The value of certain qualified property, as described in the law, such as farmland and timberland, may be deducted from the taxable value of the estate if the property is passed to a family member of the deceased person and certain other requirements are satisfied.

Thus, such farmland and timberland generally are not subject to Washington’s estate tax.

The Washington estate tax is computed according to a table in the law. The tax rates and tax amounts specified in the table are graduated to increase with the value of the taxable estate. The minimum tax rate is ten percent for taxable estates of up to one million dollars, and the tax rate increases to a maximum of 19 percent on the portion of the taxable estate over nine million dollars.

The revenues from this estate tax, including penalties, interest, and fees, are deposited in the education legacy trust account. Money in the education legacy trust account may be used only for deposit into the student achievement fund, for expanding access to higher education, and other educational improvement efforts. The education legacy trust account is funded by the estate tax, a portion of the cigarette tax, and certain interest earnings on the account.

Washington’s estate tax is independent of any federal estate tax obligations, and is not affected by the payment of federal estate taxes.

The effect of the proposed measure, if it becomes law:

This measure would repeal Washington’s estate tax. The repeal would apply to the estates of persons dying on or after the effective date of the measure. The repeal would affect only the Washington estate tax. A deceased person’s estate would still be subject to federal laws imposing federal estate tax. Repeal of the Washington estate tax would discontinue that source of revenue for the education legacy trust account.

Source: Archived Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2006 general election.

Summary of Fiscal Impact

Initiative 933 is estimated to cost state agencies $2 billion to $2.18 billion over the next six years for compensation to property owners and administration of the measure. In the same time period, the Initiative is estimated to cost cities $3.8 billion to $5.3 billion, based upon number of land-use actions since 1996, and is estimated to cost counties $1.49 billion to $1.51 billion. Costs are derived from the requirement that, with specific exceptions, state agencies and local governments must pay compensation when taking actions that prohibit or restrict the use of real and certain personal property.

Assumptions for Analysis of I-920

- State and local governments would be required to document the impact of new rules or ordinances that may affect the use or value of private property prior to its adoption and evaluate less restrictive alternatives. State agencies estimate additional costs to the rule-making process of $24 million over six years. Based upon population it is estimated to cost cities between $80 and $103 million and counties between $28 and $36 million over six years.

- Claims for payments asserting that state or local rules and ordinances result in damage to use or value to property would be triggered when state and local governments deny or restrict private property owners who file permit applications with state or local governments to develop, harvest or otherwise make use of their property. Claims would also be triggered when a state or local government took an action to enforce an existing rule, ordinance or permit.

- According to state agencies, approximately 5,920 claims per year is estimated to be filed, and would likely be made for restrictions placed upon timber harvest, surface mining, activities occurring in rivers and streams to protect fish life, activities to preserve clean water, and activities involving the state’s shorelines. Claims processing is estimated to cost state agencies approximately $1.86 million over the next six years.

- Claims-processing costs for local governments from claims in local-land use, local-shoreline management plans and critical-area designations programs are assumed in the estimates for the additional analysis required for rule or ordinance adoption.

- State agencies would need to complete appraisals to verify compensation claims, resulting in a cost to state agencies of approximately $115 million over six years. The estimate is based on costs of $7,500 per appraisal for real property and $2,600 per timber cruise. Using similar appraisal costs, but assuming they would occur when there are appeals of decisions, the estimated cost to cities is between $130 and $556 million and to counties between $13 million and $66 million over six years.

- Under existing laws, appeals related to compensation levels would be filed in Superior Court. Between 5 percent to 20 percent of all claims (275-1,100) for state agencies is estimated to be appealed annually, increasing state agency litigation costs between $29.8 million and $98.8 million over the next six years. Using a standard cost per city based upon population, it is estimated to cost cities between $126 million and $161 million over six years and counties between $35 and $45 million over six years for litigation costs.

- Superior Courts and the Courts of Appeal will have additional costs resulting from claim decisions made by state agencies. The Office of the Administrator for the Courts estimates that these costs will be divided as follows: costs to the counties will be between $495,000 and $830,000 and the cost to the state will be between $82,000 and $328,000. Assuming a total of 5,000 appeals from state and local government action, there would be an additional $3.9 million in first year costs and $2.7 million in subsequent years.

- Assuming there are 5,920 claims per year, state agencies have estimated a range of compensation between $344 million and $352 million annually or $1.89 billion to $1.9 billion over six years. This estimate does not include compensation that may be required for restrictions placed upon 900 Hydraulic permits annually issued by the Department of Fish and Wildlife, which cannot be determined due to the highly site-specific requirements for these permits. Also not included are compensation estimates for timber-harvest restrictions occurring on unstable slopes or to protect marbled murrelet habitat; restrictions for Bald Eagle Site Management Plans occurring on nonresidential permits; and for setbacks to protect drinking water systems or setback and lot size requirements for onsite sewage systems required by the Department of Health.

- It is estimated to cost cities between $3.5 billion and $4.5 billion to pay compensation for actions that have occurred since 1996. The estimate is based upon a survey of cities on possible impacts, population growth rates, and assessed value.

- County governments planning under the Growth Management Act could see potential claim for compensation of approximately $1.4 billion over six years. This is based upon the potential compensation request for loss in value for acreage equivalent to that contained in the counties urban growth areas. No estimate is included for a loss in value for counties not planning under the Growth Management Act because of the inability to determine the number of acres in each county designated as critical areas such as geologic hazards, critical fish and wildlife habitats, wetlands, aquifer recharge areas or frequently flooded areas.

- These compensation estimates assume that state agencies and local governments will be unable to waive any current restrictions that may reduce the use or value of private property. It is also assumed that the state will not delegate back to the federal government federally delegated programs (i.e., Clean Water Act, Clean Air Act, etc.). No estimate has been made for any future actions taken by governments that may require compensation or for actions that attempt to reduce liability caused by the Initiative.

- The compensation estimates are also based primarily upon potential loss in value to real property. No estimate has been made for any potential loss to personal property.

- State law does not allow for the estimation of private costs or benefits from this or any other initiative.

Source: Archived Washington State Voter’s Pamphlet; Archived OFM website

Voter’s pamphlet argument against I-933

The following is the text of the argument that appeared in the 2006 voter’s pamphlet urging a no vote on I-933, including the rebuttal.

A POORLY WRITTEN, LOOPHOLE-RIDDEN INITIATIVE THAT LEAVES HUNDREDS OF QUESTIONS UNANSWERED

Initiative 933 is deceptive and misleading. It provides no protection from eminent domain abuses. Instead, the special interests behind I-933 crafted loopholes that force Washington taxpayers to pay billions to a small group of property owners, or force communities to waive safeguards against irresponsible development.

WHO BENEFITS FROM I-933’S LOOPHOLES?

Here is an example of how the loopholes work. If laws prevent a property owner from expanding a strip mall in a neighborhood or building a subdivision on farmland, I-933 would force the community into a no-win choice—either waive the law or have taxpayers pay the property owner for not being able to build.

How will governments decide which laws to waive and who taxpayers pay? One thing is certain: I-933 is so poorly written it will generate endless lawsuits. Special interests will hire the best lawyers and win out over communities. The lawyers’ fees and administration alone will cost taxpayers millions.

Don’t be fooled – irresponsible development hurts farming. Hundreds of family farmers oppose I-933.

WHY WILL I-933 COST TAXPAYERS SO MUCH? AND WHERE WILL THE MONEY COME FROM?

In Oregon, a similar law generated almost $4 billion in claims against taxpayers. I-933 could cost each Washington taxpayer thousands yearly in additional taxes or lost services.

HOW WILL I-933 HARM SAFEGAURDS FOR OUR COMMUNITIES?

Communities have worked hard to protect their quality of life, but I-933 applies retroactively to laws going back at least 10 years! This would force communities to waive hundreds of existing safeguards we have depended on to protect neighborhoods and farmland, prevent water pollution, traffic and over-development.

I-933 is a costly assortment of loopholes, lawsuits, and special deals. Please vote no!

For more information, call 206.323.0520.

REBUTTAL OF STATEMENT FOR

What’s fair about irresponsible development? Worse traffic? More taxes? Ask yourself who stands to gain from I-933’s loopholes.

Far from restoring balance, I-933’s loopholes allow irresponsible development to damage farmlands. That’s why farmers and farm-workers oppose it – including Western Washington Agricultural Association, Whatcom County Agricultural Preservation Committee, and United Farm Workers.

There’s nothing fair about thousands of dollars in new taxes each year, damaging our neighborhoods, and jeopardizing our quality of life. Vote no.

Source: Archived Washington State Voter’s Pamphlet

Additional analysis

- University of Washington’s Northwest Center for Livable Communities: The impacts of proposed Initiative 933 on real property and land use in Washington State

- Hugh Spitzer, Foster Pepper LLC: Application of I-933 to personal property

- Washington Chapter of the American Planning Association: Analysis of Proposed Initiative 933 & its Consequences for Washington

- Association of Washington Cities:

- Washington Environmental Council & Futurewise: Section by Section Summary & Analysis

- Futurewise & Washington Environmental Council: I-933 Impact Summary

- Department of Ecology: Analysis of Initiative 933